Application and industry analysis of aluminum alloy forgings in automobiles

Aluminum alloy forgings are not only used in automobiles but also in motorcycles and bicycles, such as Harley motorcycles and sports bicycles. Aluminum is a light metal with excellent characteristics and high-cost performance. It is widely used in the body. As the energy density of vehicles reaches the upper limit, the overall design, structural improvement, and lightweight will continue to increase the cruising range. Lightweight increases cruising range saves energy and is beneficial to the environment. How is the current development of the aluminum alloy forging industry? What are the development trends in recent years? Where are the investment opportunities in this field?

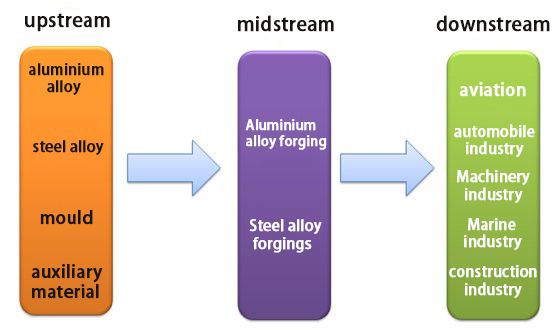

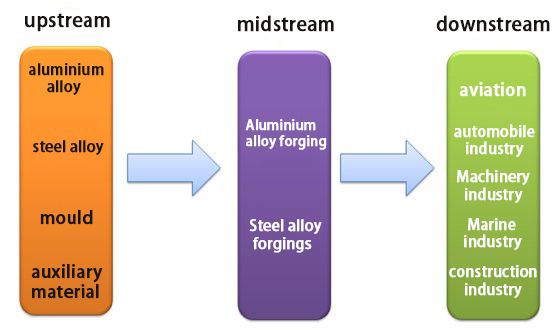

1. Introduction of the aluminum alloy forging industry and its upstream and downstream

Among metal parts, precision structural parts are a very important segment. Precision structural parts refer to plastic or hardware parts that have the characteristics of high dimensional accuracy, high surface quality, and high-performance requirements, and play the roles of fixing, protecting, supporting, and decorating industrial products.

The application of precision structural parts is very extensive. The main downstream industries include automobiles, lithium batteries, energy storage power stations, communication equipment, electromechanical equipment, aviation equipment, high-speed locomotives, and other fields that have strict requirements on the processing accuracy and product quality accuracy of structural parts. Products range from space shuttles and military machinery to household appliances and electronic accessories. In terms of precision structural parts in different application fields, their functions, characteristics, appearance, and cost are also quite different.

Chart 1 Upstream and Downstream Situation of the Industry

The upstream industry has a relatively high degree of marketization, relatively sufficient competition, and a sufficient supply of raw materials, which will not have a major impact on manufacturing companies. The downstream automobile industry continues to introduce new models and innovates in vehicle structure and process flow, which requires suppliers to adapt to the requirements of OEMs. The customers of aluminum alloy forging manufacturers are generally not the OEMs, but the first-tier suppliers of the OEMs, including world-renowned auto parts manufacturers such as Bosch, Continental, and Gates.

The main production process of aluminum alloy forgings includes: blanking → hot forging → T2 → film → rough forging (cold) → T2 → film → precision forging (cold) → T2 → water rising → spinning → T4/T6 → whitewashing → CNC1 →CNC2→CMC→ Laser marking →Cleaning→Full inspection→Packaging (water swelling and spinning are subcontracted processes). The core technology of production lies in mastering the whole process from hot forging to a full inspection, and can continuously improve the process and processing complexity according to customer requirements. The mold manufacturing process is also difficult and requires long-term experience accumulation and experiments.

2. Development trend of the aluminum alloy forging industry

As an important part of the car, auto parts are the units that constitute the overall processing of auto parts and the products that serve the processing of auto parts, which have an important impact on the service life and driving comfort of the car. On the whole, traditional auto parts can be roughly divided into seven categories: engine, transmission system, steering system, braking system, driving system, body accessories, and electronic appliances. The metal structural parts produced by Liye include precision forging parts, precision machined parts, body structure, chassis parts, automotive electronics, and engine metal parts.

(1) Energy conservation and emission reduction promote the penetration of automotive lightweight structural parts, and aluminum is the preferred material for lightweight

Experiments have proved that if the weight of the vehicle is reduced by 10%, the fuel efficiency can be increased by 6%-8%; for every 100 kg of vehicle curb weight reduction, the fuel consumption per 100 kilometers can be reduced by 0.3-0.6 liters; the weight of the vehicle is reduced by 1%, and the fuel consumption can be reduced by 0.7 %.

In 2017, the total emissions of the four pollutants from motor vehicles decreased by only 2.5% year-on-year. Among them, the share rate of the four pollutant emissions of automobiles is more than 80%, which is the main source of pollutant emissions. In 2018, China’s “National VI” standard came into effect, requiring all types of emissions from newly sold vehicles to be reduced by 30-50%, and the fuel consumption level to be significantly reduced. In addition to optimizing engine combustion and emissions, OEMs also need to apply more lightweight components to reduce vehicle weight and assist in achieving the goal of emission reduction.

There are three main ways to realize the lightweight of the car, among which the lightweight application of materials is the fastest and best choice. In the field of material application lightweight, aluminum alloy has become the main way to realize the development of automobile lightweight due to its low density, high-quality performance, and huge stock.

(2) Aluminum alloys have been widely used in European and American automobile markets

Germany is currently the country with the highest proportion of automotive lightweight materials, followed by the United States and Japan. In 2015, Germany’s new production of automotive aluminum alloys and other new materials accounted for as high as 25% of the body and chassis. It is currently the country with the highest proportion of automotive lightweight materials in the world. By 2020, the use of new materials will continue to rise, reaching 34%. %about. Secondly, there are many luxury brand models in the United States, and electric vehicles are developing rapidly; Japan ranks first in the world in terms of carbon fiber, and China started lightweight relatively late, and its technology and application level lag behind developed countries such as Germany, the United States, and Japan. However, with the development of new energy vehicles, the lightweight of materials is accelerating.

China’s lightweight materials market is vast. On the one hand, compared with foreign developed countries, China’s lightweight technology started late, and the average vehicle weight is higher. Taking the proportion of foreign lightweight materials as a benchmark, China still has a lot of room for development; on the other hand, benefiting from the policy Driven by the rapid development of China’s new energy vehicle industry, it will drive the demand for lightweight, prompting car companies to move forward in the direction of lightweight.

(3) The penetration rate of aluminum alloy in auto parts is increasing

According to the statistics of Drive Aluminum, in 2015, the market penetration rate of aluminum alloy in automobile bodies and panels was only 6.6%. With the increasing call for emission reduction and low consumption, the market penetration rate of aluminum alloy will reach 26.6% by 2025. Among them, the penetration rate in the cover will reach 85%, the penetration rate of the all-aluminum body will reach 18%, and the penetration rate of the door will reach 46%. For engine blocks, the market penetration rate of aluminum alloys in North America is expected to reach 85% by 2025. It is estimated that by 2025, the total demand for aluminum alloys in the North American auto market will reach 4.54 million tons, and the market space is huge.

Like this page? Share it with your friends!